Harmonic patterns in Forex are patterns defined by the market shape which can be used to determine future market movement.

Using Fibonnaci ratios, harmonic patterns have been created to give accurate entry and exit signals.

Used with other technical tools like support and resistance levels, harmonic patterns can be profitable for a trader.

Forex Harmonic Patterns

Harmonic patterns are called patterns because they appear in the same or similar shape more than once. Pattern is called Harmonic because it tends to repeat with some frequency .

So when you use the term harmonic pattern it means that something is repeating all the time with some frequency.

In trading you have price patterns that repeat all the time in the Forex market and they are called harmonic patterns.

When you add Fibonnaci numbers to the harmonic pattern you get a geometry pattern which repeats in the markets and using Fibonnaci numbers you can predict future price movement.

So, if you have a trend in the Forex market, that means the price is moving in one direction. That trend does not move in a straight line, but it makes some legs UP or DOWN.

Those legs are also called waves which can be predicted because sometimes they can form a geometry pattern which is called a harmonic pattern.

Specific patterns that appear frequently have their own name and that is how we got name harmonic patterns.

Who Invented Harmonic Patterns

First person who defined harmonic patterns was H.M. Gartley in 1932. His first harmonic pattern was Gartley harmonic pattern defined with 5 points.

Later on there were others who invented other harmonic patterns. Most known person is Scott Carney who invented Crab, Bat, Shark and 5-0 harmonic patterns.

How Many Harmonic Patterns are There?

There are six main harmonic patterns on the market, but you can find even more which are derivative of the six main patterns.

Six main harmonic patterns are:

Four harmonic patterns that are bolded are the most popular among traders.

Other harmonic patterns that appear on the market are:

- The alternate Bat

- Deep Crab

- ABCD pattern

- XABCD pattern

- 121 pattern

- 5-0 pattern

- Three drives pattern

Do Harmonic Patterns Work

Harmonic patterns do work and they can be profitable in the long term trading. Harmonic patterns to work it is necessary to use additional tools like support and resistance.

If you use support and resistance with harmonic patterns you will increase success rate because entry level of harmonic patterns mixed with support and resistance entry level will increase winning rate.

Second thing that you can to do make harmonic patterns even more successful is to use price action patterns, like Pinbar and Engulfing bar, which will also increase accuracy.

So, harmonic patterns do work, but you need to test and find a trading strategy which will include additional simple tools.

Harmonic patterns on their own do work, but you will have less accurate entry levels and less profitable trades. And that is because you will have harmonic patterns appear on all market conditions even if they do not work. So that can mislead you to open a trade which could end up as a losing trade.

How Accurate are Harmonic Patterns in Forex?

Harmonic patterns are accurate and precise when the pattern forms by all details which describe the perfect pattern. The most accurate harmonic pattern will form a movement that will coincide with legs with proper magnitude and it will give precise reversal entry level. That level is also called potential reversal zone where few Fibonnaci ratios meet together.

To confirm accuracy of the harmonic pattern you need to wait until all aspects of a perfect harmonic pattern is visible on the chart.

And that is Fibonnaci levels align with the pattern.

To make that happen you will need to be patient, accurate and disciplined. If you are not disciplined you will think that market shape is a harmonic pattern even if it is not.

To protect yourself you can use harmonic scanner which is a tool that detects harmonic patterns on the chart. Second way is to make a step by step strategy that you will follow.

Strategy will guide you to confirm each leg of the harmonic pattern to verify it is valid.

Success rate of the Harmonic patterns can be as high as 90%, but to make that happen you need to backtest and confirm certain harmonic patterns.

How do I Learn Harmonic Patterns

The way how to learn hamornic patterns is to start reading about them. Reading about them and then practicing on the trading platform by drawing harmonic pattern legs will give you more experience than just reading.

Learning how to draw and to use harmonic patterns will take some time. If you are a beginner in trading you will need much more time to learn about trading basics and then learning how to draw, detect or read harmonic patterns.

Detecting harmonic pattern requires trained eye and knowing fundamental rules how to draw each leg of the harmonic patter without breaking the harmonic pattern rules.

Learn With a Mentor

One of the ways to learn Harmonic patterns is to follow someone who knows how to trade harmonics. That way you will see what to look for when you open a trading platform.

Then, you will see which rules must be obeyed in order to view harmonic patterns on the chart. You will see how each leg of the harmonic pattern is drawn. How those legs combined make a certain harmonic pattern.

Learn With Harmonic Scanner

Second way is using harmonic scanner tool which draws harmonic patterns for you. It is a tool you can use in your browser or on the PC. It depends which version you use.

Harmonic scanner works as an algorithmic software that is written to detect harmonic patterns. By watching when the scanner draws a harmonic pattern you can learn how each pattern looks.

By watching and practicing on the side you can learn the most important rules when using harmonic patterns in trading.

How do You Make a Harmonic Pattern?

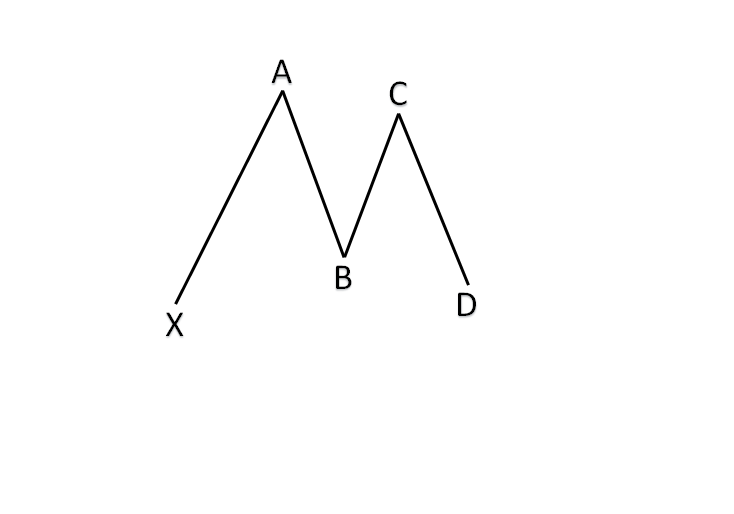

Harmonic patterns consist of 5 legs which are marked as letters. Those letters are X, A, B, C, D which forms XABCD pattern.

To make a harmonic pattern you need to connect those five letters with straight lines. How to draw them correctly depends on the distance between those legs.

The distance between legs is defined by the Fibonacci ratios.

Fibonacci numbers are a sequence of numbers where each number is the sum of the previous two numbers.

The series of Fib Numbers begin as follows: 1,1,2,3,5,8,13,21,34,55,89,144,233…

The basic Fibonacci ratio is the Golden Ratio (1.618).

Key Fibonacci ratios in trading are: 0.382, 0.618, 0.786, 1.0, 1, 1, 2.0, 2.62, 3.62, 4.62

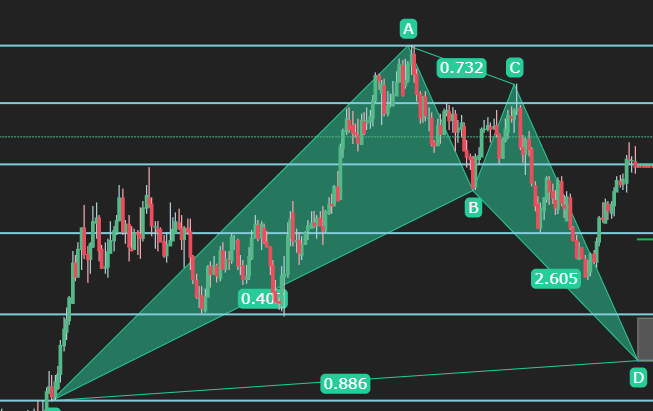

Harmonic patterns that consist of 5 points like in the image above have a start point X followed by an impulse wave to the point A.

Then a corrective wave from A to B which makes AB leg.

Then the third wave B->C and finally completed by a corrective leg C->D.

How do You Identify Harmonic Patterns?

Each of the harmonic patterns have its own rules that are clearly defined. You need to follow them to get a pattern on the chart ready for trading.

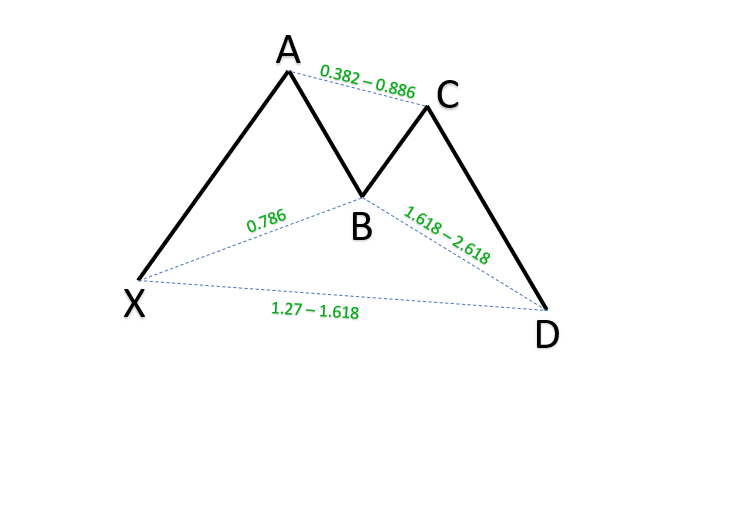

For example, Butterfly pattern rules are:

- AB = 0.786 or 78.6% retracement of the XA swing leg

- BC = minimum 38.2% – maximum 88.6% of AB swing leg

- CD = minimum 1.618 – maximum 2.618 of AB swing leg

- CD = minimum 1.272% – maximum 1.618% of XA swing leg

Image below shows a bullish Butterfly pattern with 5 points and 4 legs. Distances between points are also marked on the image so you can see how does that looks.

Your job is to find swing points from X to A point and then from A to B point. From there it is easy to draw other legs because you have ratios to follow.

It can be hard at the start of a trading journey to spot the swing leg from X to A, and then to draw other legs. But, in time as you practice you can succeed.

Great tool for drawing harmonic patterns is a harmonic scanner that is programmed to draw patterns for you. Professional scanners come with a monthly fee, but the price is worth it if you do not have time to watch the screen all the time.

Which Harmonic Pattern is The Best?

The best harmonic pattern is the Crab pattern where you have a high risk to reward ratio which gives you the best trading results.

This information is given by Scott Carney who invented the Crab pattern.

But, one thing you need to have in mind is that harmonic patterns on their own do not work as good as when you combine other trading analyzing tools. Like support and resistance, price action, candlestick patterns like Pin bar and engulfing bar.

When you combine them together you can get better trading results. So, when you use other harmonic patterns like Butterfly you can also get really good trading results.

At the end you get the best harmonic pattern when you do testing for yourself on the chart. When you get good trading results that will be the best pattern for you.

Reason for this is because you as a trader do not see the chart pattern or any other pattern like other traders. You are unique so the best pattern maybe will not be the Crab as I mentioned above, but some other pattern.

It is mandatory to make the backtesting and see which harmonic pattern is the best fit for you and your trading style.

How do You Trade Forex Harmonic Patterns

Trading harmonic patterns requires steps like:

- detecting pattern on the chart

- confirming which pattern it is so you know how to trade it

- find entry point and exit point

- calculate good risk to reward ratio

It sounds easy as a four step, but in reality is not like that.

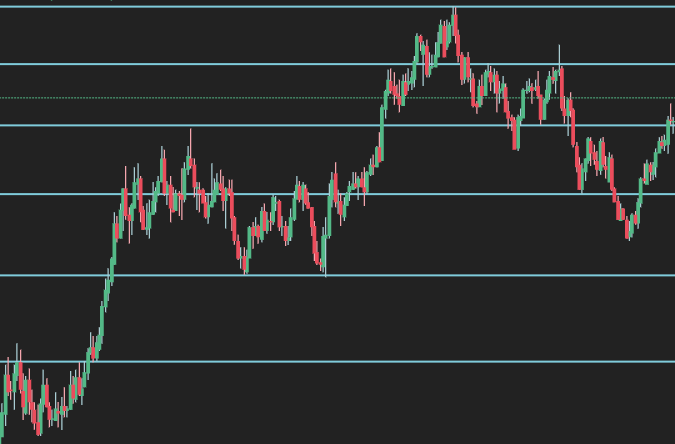

First point is to detect that pattern on the chart. Let’s take one example.

Image below shows EURUSD chart on daily time frame. How would you trade this pair at this moment?

Do you see any harmonic pattern?First you need to find swing points and draw them on the chart.

I have found five points and I have drawn white lines and connected those swing points.

When you draw the first four points, X->A, A-B and B->C, you need to see which pattern has this shape and the distance between swing points. You need to measure the length of the legs.

When I see these retracements I can start to validate which harmonic pattern it is.

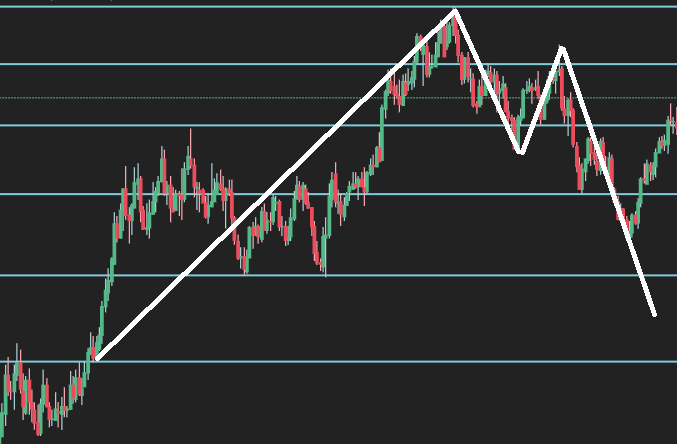

Below image shows the ratios between swing points. When you check harmonic patterns and their definition you can see that this is a bullish Bat pattern.

Bullish Bat pattern have:

- A->B leg the price then reverses and retraces from 38.2% to 50% of the X-A leg

- B->C leg the price reverse again and retrace from 38.2% to 88.6% of the A-B leg

- C->D leg – the price reverses and achieves an 88.6% retracement of the X-A leg

You see that I have point D as an entry level where I can open order.

Stop Loss is below X point because if the price drops below it means the Bat pattern is not valid.

Take profit level is in the middle of X->A leg.

Books on Harmonic Patterns

What can be suggested on harmonic books are these below where Scott Carney has two best books on the market.

- Harmonic Trading Volume 1

- Harmonic Trading Volume 2

- Chaos and Order in the Capital Markets

- Chaos – The Amazing Science of the Unpredictable

- The (Mis)Behaviour of Markets

- Trade What You See” and “Fibonacci Ratios with Pattern Recognition

- Trading in the Zone” and “The Disciplined Trader

I have made a list of harmonic trading books for you if you are interested to check them out.

Conclusion

Harmonic patterns are a good tool in trading to get a good risk to reward ratio. If they are used with other analyzing tools like support and resistance they can increase profitability of each trade.

It takes experience to spot harmonic patterns on the chart, but there is also a solution for that in harmonic patterns scanner who detect them automatically.

Trading harmonic patterns takes time, but at the end they are good trading patterns. You have various tools and books you can use to learn all about them so take your time and invest in learning how to trade harmonic patterns.

Harmonic Patterns Cheat Sheet

All Harmonic Patterns on one place with important tips for trading.

0 Comments