Finding Quality Zones To Trap Price

Price trap is an amazing strategy in harmonic trading, but where to find price trap zones can be challenging

Is that a zone?

So you have read the Price Trap Strategy and found the ideal harmonic pattern within a currency pair. Now you need to find the zones to trap price. This can be challenging at first but many newcomers downfalls are, they overthink the process.

Finding your zones will become clearer to the naked eye by backtesting. This will help train your eye to spot these prime areas much more easily in the live markets.

Relax…

Relax, the zones will not come to you overnight. It takes time to develop this skill. Backtesting the strategy will help you find key zones for future trades.

Backtest

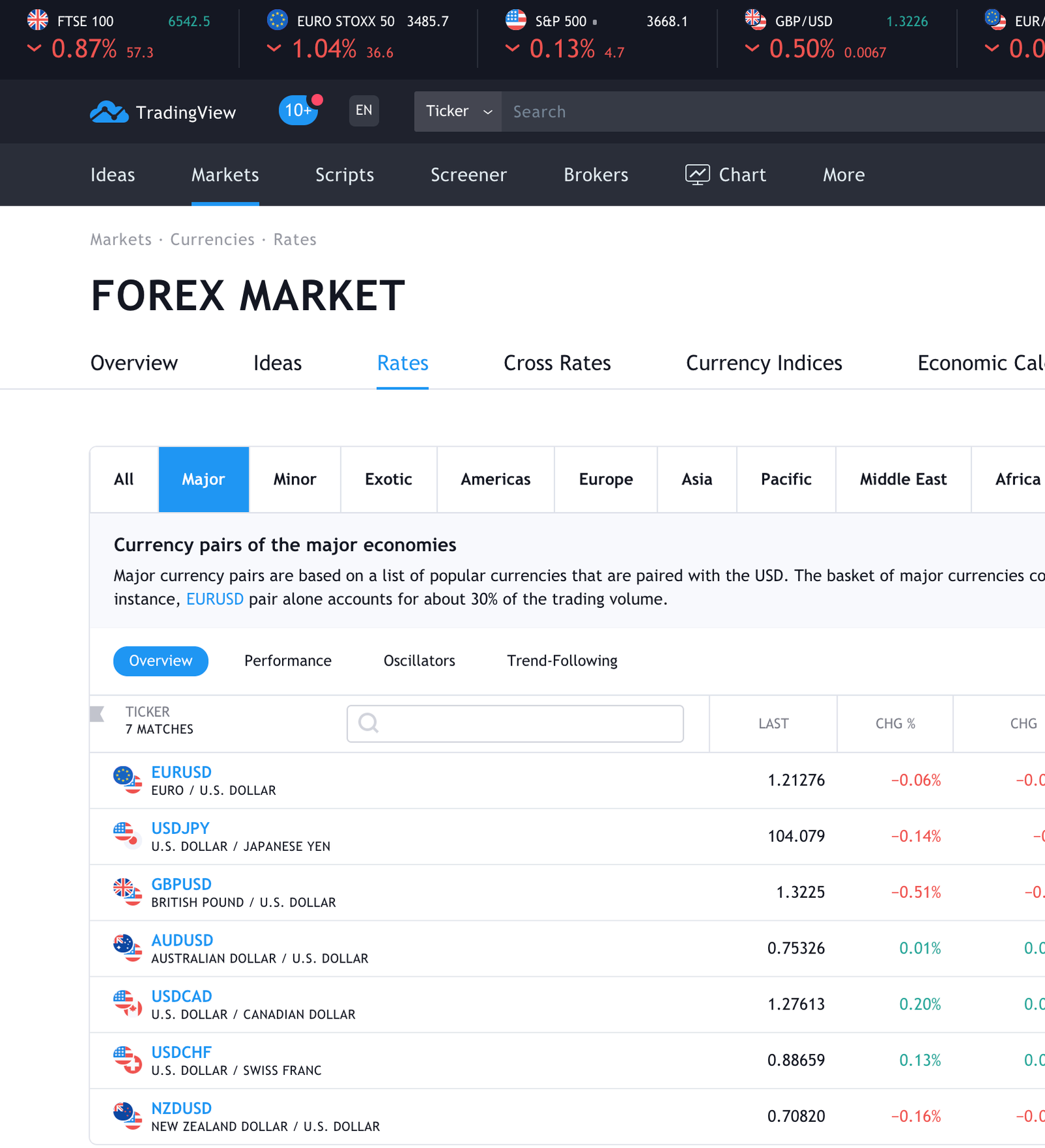

Backtest your zones, use the replay function within TradingView to achieve this. By replaying past movements it will help you become more confident within the markets.

Take a look at the bigger picture

The bigger the picture, the easier to see right? You don’t use a magnifying glass to look at a post on Facebook, so why do it on your charts?

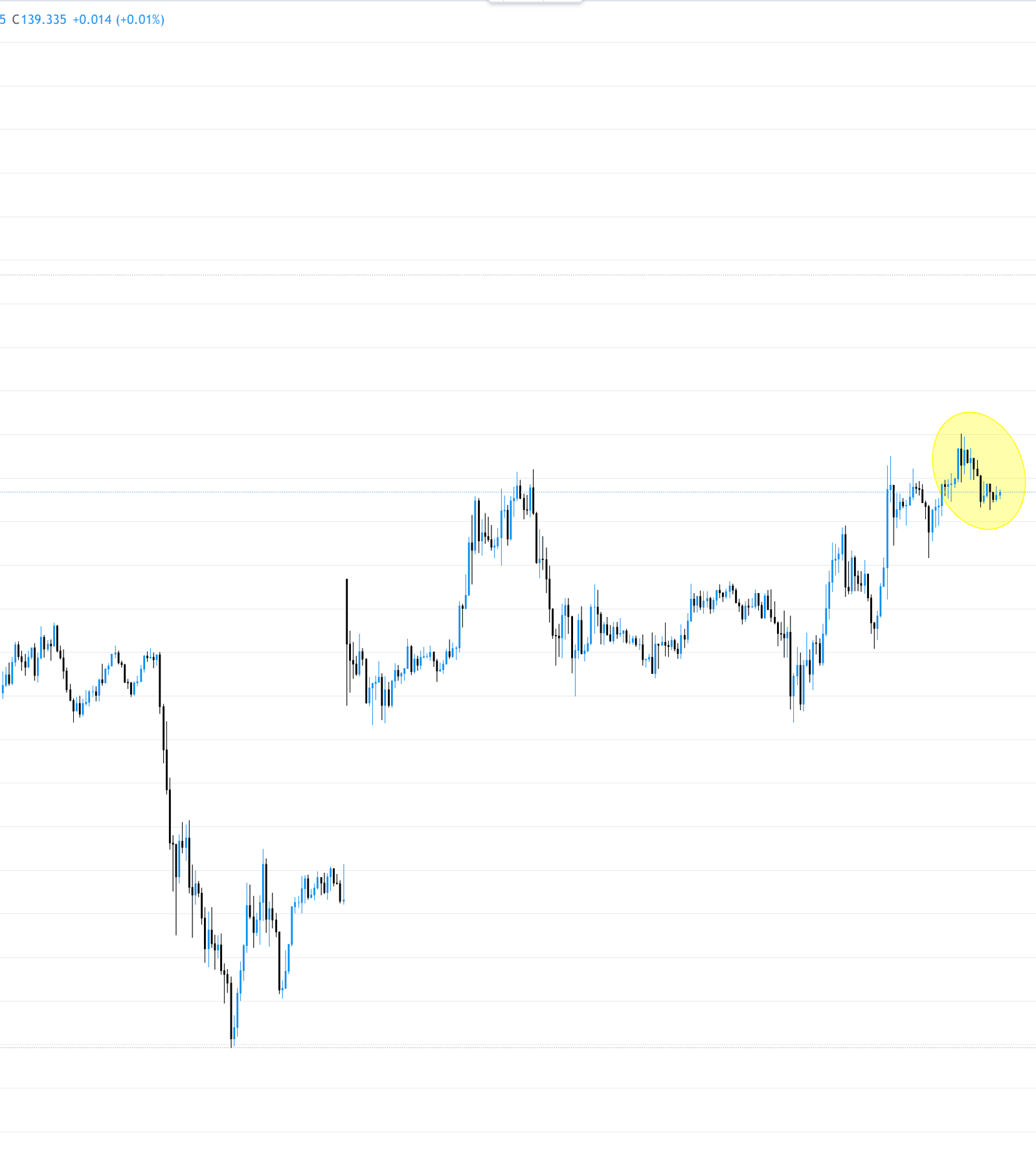

Zoom out on the charts so you can clearly see the past 7 – 10 days. By doing this you are able to see the bigger picture. Most importantly, you can see previous support and resistance levels.

Zoom Out!

Over 70% of people struggling to find zones have found that zooming out helps them find zones for price trap much easier.

See The Bigger Picture

Being able to see previous support and resistance within the markets will help you spot the current day’s price trap zones.

Look at where price currently is

Take a look at where the price actually is. What do I mean by this you are probably asking?

Focus on the most recent high and the most recent low. This can usually be indicated by engulfing candles within sessions to determine that trading session’s high or low.

Once you have spotted the most recent high or low, is it within 30 pips? If it is not, then this strategy may not be suitable at this time.

If the range is within 30 pips, we can move to the next step to finding our zones for price trap.

I have a high and a low

So the high and the low are in place, we have the charts zoomed out, we can see the past 7 days. We now need to place a single horizontal line on the high and the low.

Let’s focus on the HIGH line first. Doe the horizontal line on the current high show areas of good support or resistance in the previous days? If the answer is no, this trade may not be suitable for price trap at the current time.

If the answer is yes, let’s check the LOW line for previous support and resistance areas. Do you have valid support and resistance? If the answer is no, this trade may not be suitable for price trap at the current time.

If yes, we can move onto the next step.

Previous Touches

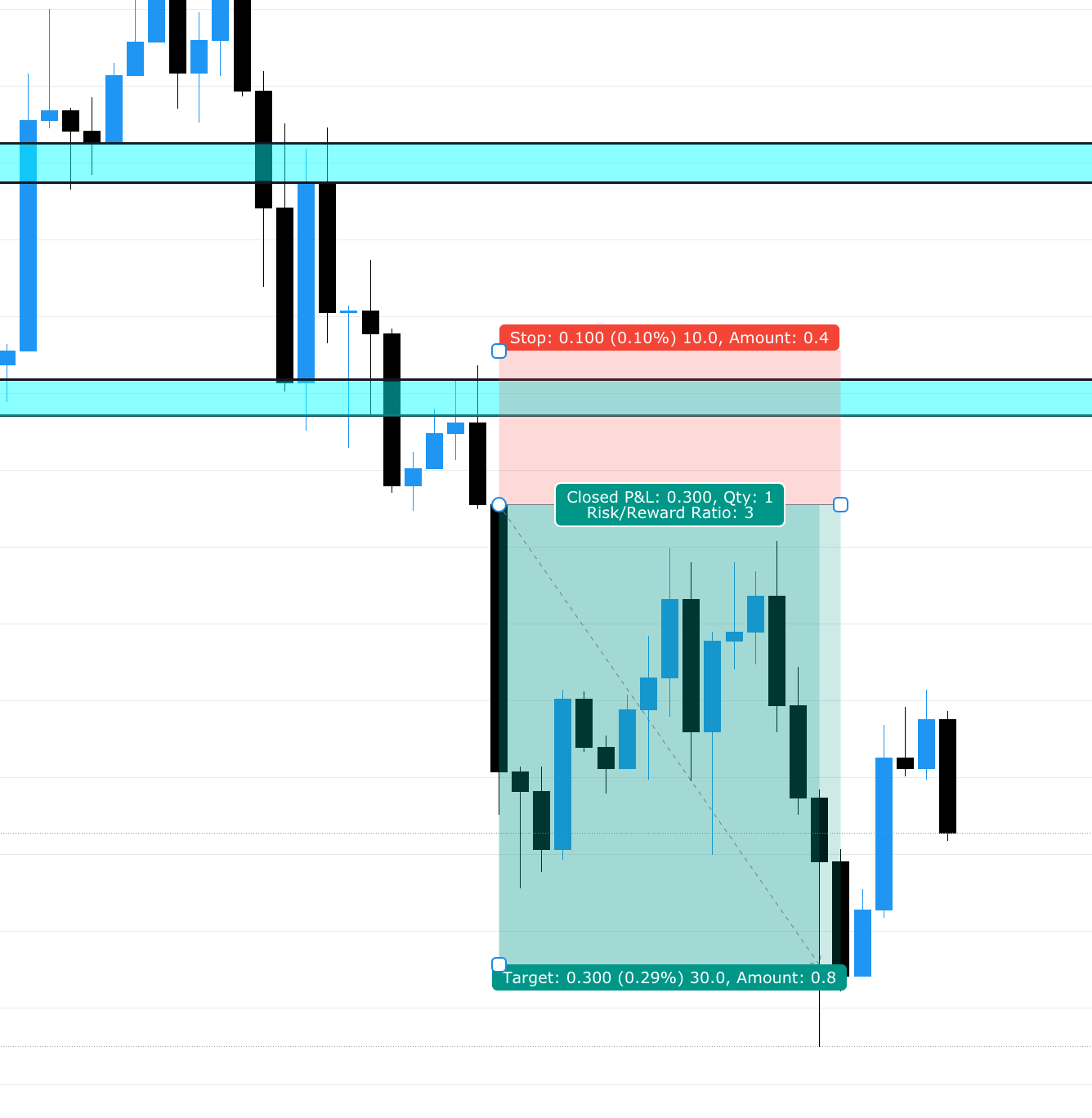

Ensure the lines you have drawn have a good amount of touches along that line. Three or more is one of my rules. It’s up to you to define this value in your own trading plan.

No Previous S&R?

None or not enough touches? The zones you have selected should not be used. Try zooming out more, if this does not solve the problem, do not trade that currency pair today.

Improving your zones

Take yourself back to the PAST areas of support and resistance. For example, 6 days ago I have support reacting off my HIGH line. Using this area, add another horizontal line. This will create a BOX or what I like to call, a Sheet Of Ice.

Adjust the ICE thickness to capture wicks and bodies.

Remember, if the ice is too thin and it could break easily or too thick and it will take more to break.

Keep these zones between 5 and 7 pips (you can use the ruler tool within TradingView for this)

Proceed and do the same for the LOW line as you have with the HIGH line.

Be confident

If you have followed the steps above, you should be feeling very confident with your chosen Price Trap Zones.

This is a good sign, but remember to manage your risk appropriately when entering ANY trade.

To recap on finding zones with Price Trap

This strategy requires a lot of patience, I urge you to backtest and LIVE TEST your zones for at least 1 month before implementing into a real trading account.

This is not financial advice and is strictly for educational purposes only.

0 Comments