Top Risk Management Strategies

Volatility within the forex market presents great opportunities for profit, but this is only possible with risk. Learn about the risks associated with forex harmonic trading, and find out how to manage them.

What is forex risk management?

Risk management within forex enables you to implement a set of rules and measures to ensure any negative impact of a forex trade is manageable. An effective strategy requires adequate planning from the outset. It’s better to have a risk management plan in place before you actually start trading.

What are the risks of forex trading?

- Interest rate risk is related to the sudden increase or decrease in interest rates. This affects volatility. Interest rate changes affect forex prices because the level of spending and investment across an economy will increase or decrease. This is dependant on the direction of the rate change

- Currency risk is associated with the fluctuation of currency prices. Fluctuations make it more or less expensive to buy foreign assets

- Liquidity risk is the risk that you can’t buy or sell an asset quickly enough to prevent a loss. Even though forex is a highly liquid market, there can be periods of illiquidity. This depends on the currency and government policies around the foreign exchange.

- Leverage risk is the risk of magnified losses when trading on margin. Because the initial outlay is smaller than the value of the trade. It’s easy to forget the amount of capital you are putting at risk.

Understanding The Forex Market

The forex market is made up of currencies from all over the world, which includes USD, GBP, JPY, AUD, CHF and ZAR. The forces of supply and demand primarily drive forex markets, also known as foreign exchange or FX.

Forex trading works like any other exchange where you are buying one asset using a currency. The market price tells you how much of one currency you need to spend in order to buy another.

The first currency that appears in a forex pair quotation is called the base currency and the second is called the quote currency. The price displayed on a chart will always be the quote currency. The quote represents the amount of the currency you will need to spend in order to purchase one unit of the base currency. For example, if the EUR/USD currency exchange rate is 1.25000, it means you’d have to spend $1.25 to buy €1.

Let’s Talk About Leverage

When you speculate on forex price movements with spread bets or CFDs, you will be trading on leverage. This enables you to get full market exposure from a small initial deposit. This is known as margin.

While trading on leverage has its benefits, there are also downsides, the possibility of magnified losses.

Let’s say you decide to trade EUR/USD using CFDs, and the pair is trading at $1.25485, with a buy price of $1.25490 and a selling price of $1.22480. You think that the euro is set to gain value against the US dollar, so you decide to buy a mini EUR/USD contract at $1.25490.

In this case, buying a single mini EUR/USD CFD is the equivalent of trading €10,000 for $12,549. You decide to buy three CFDs, giving you a total position size of $36,747 (€30,000). However, because you’re trading the forex pair using leverage, your margin will be 3.33%, which is $2,153.65 (€999).

There are three different types of forex markets

Spot Market

The physical exchange of a currency pair takes place at the exact point the trade is settled – ie ‘on the spot’

Futures market

A contract is agreed to buy or sell a set amount of a currency at a set price and date in the future. Unlike forwards, a futures contract is legally binding

Forward Market

A contract is agreed to buy or sell a set amount of a currency at a specified price, at a set date in the future or within a range of future dates

Build A Trading Plan

A trading plan helps make your trading easier by acting as your personal decision-making tool. A trading plan can also help you maintain discipline in the volatile market. The purpose of this plan is to answer important questions, which includes what, when, why, and how much to trade.

It is extremely important for your forex trading plan to be personalised to you. Copying someone else’s plan is not a solution, this is because that person will very likely have different attitudes, goals and ideas. They will also certainly have a different time schedule and money to dedicate to trading.

A trading journal is another tool you can use to keep a record of trades – from entry and exit, to your emotional state at the time of the trades.

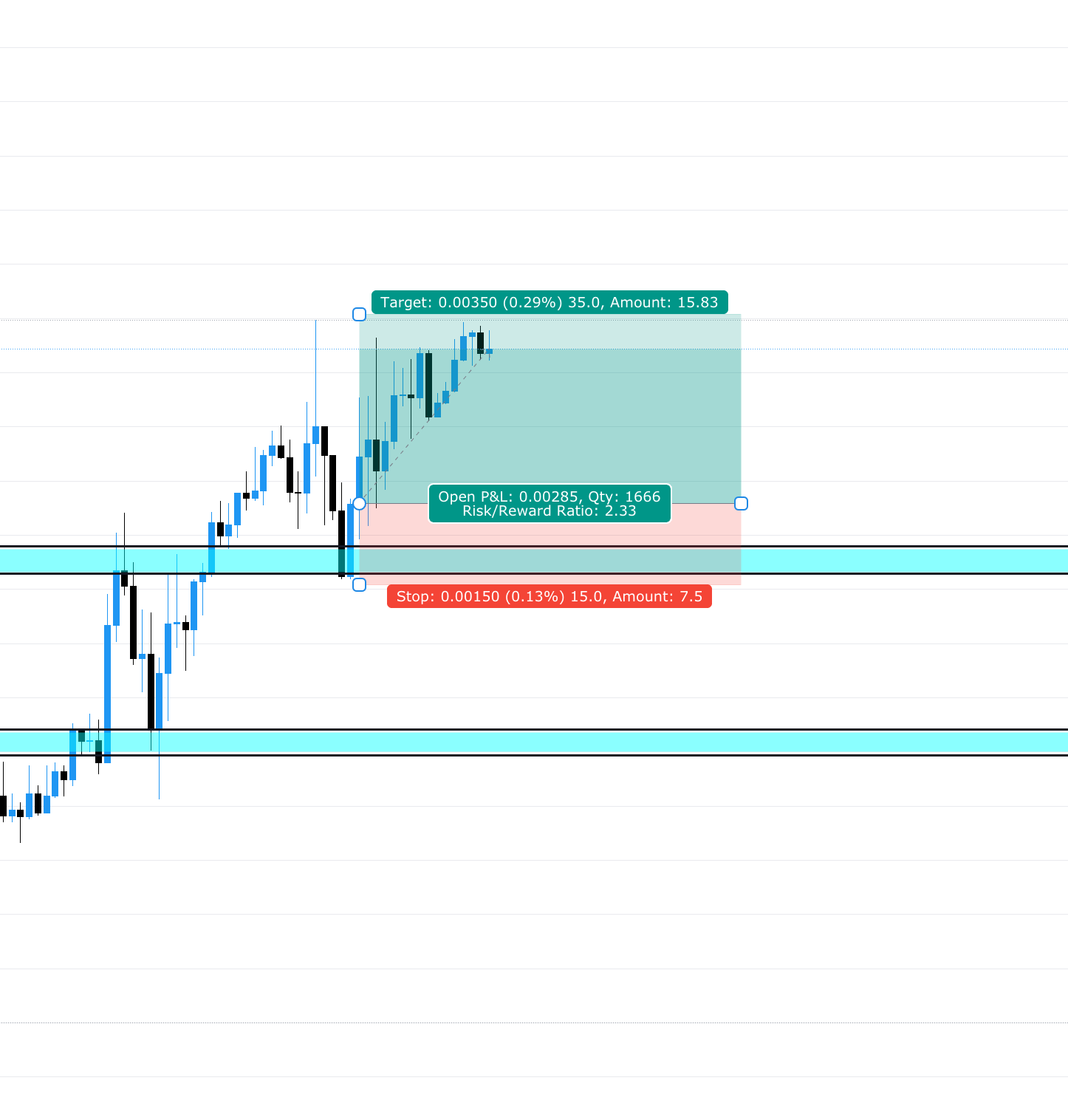

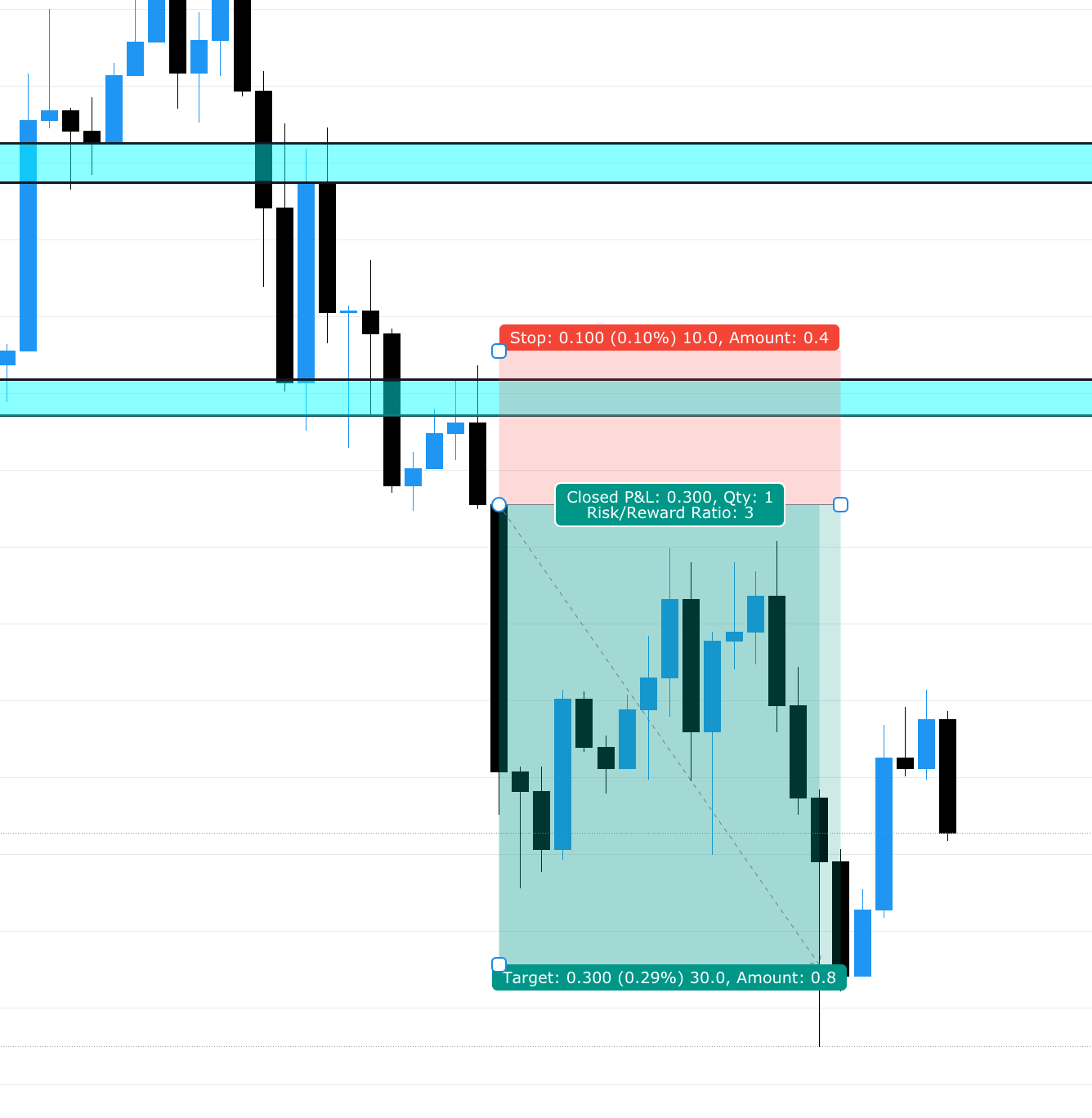

Risk To Reward Ratios (RRR)

With every trade, the risk you take with your capital should be worth a good return. Ideally, you want your profit to outweigh your losses. Making money in the long run, even if you lose on individual trades is desired. As part of your trading plan, you should set your risk-reward ratio to quantify the worth of the trade you place.

To find the ratio, compare the amount of money you’re risking on a trade to the potential gain. For example, if the maximum potential loss (risk) on the trade is €100 and the maximum potential gain is €500, the risk-reward ratio is 1:5. So, if you placed ten trades using this ratio and were successful on just four of them, you would have made €1,400, despite only having a win rate of 40%

If you were to use a 1:1 risk to reward ratio you would need to have a win rate of at least 60% to be profitable.

Would you play a slot machine that costs €10 a spin to only win back €10?

Stop losses and limits

Because the forex market is particularly volatile, it is very important to decide on the entry and exit points of your trade before you open a position. You can do this using various stops and limits:

- A Stop-Loss will close your position automatically if the market moves against you.

- Trailing Stop-Losses will follow positive price movements and close your position if the market moves against you.

- Limit orders will follow your profit target and close your position when the price hits your chosen level

Control your emotions

Volatility in the forex market can play on your emotions. There’s one key component that affects the success of every trade you make, you. Emotions like fear, greed, doubt, temptation and anxiety could either lure you in to trade or cloud your judgment. If your feelings get in the way of your decision-making, it could negatively impact the outcome of your trades.

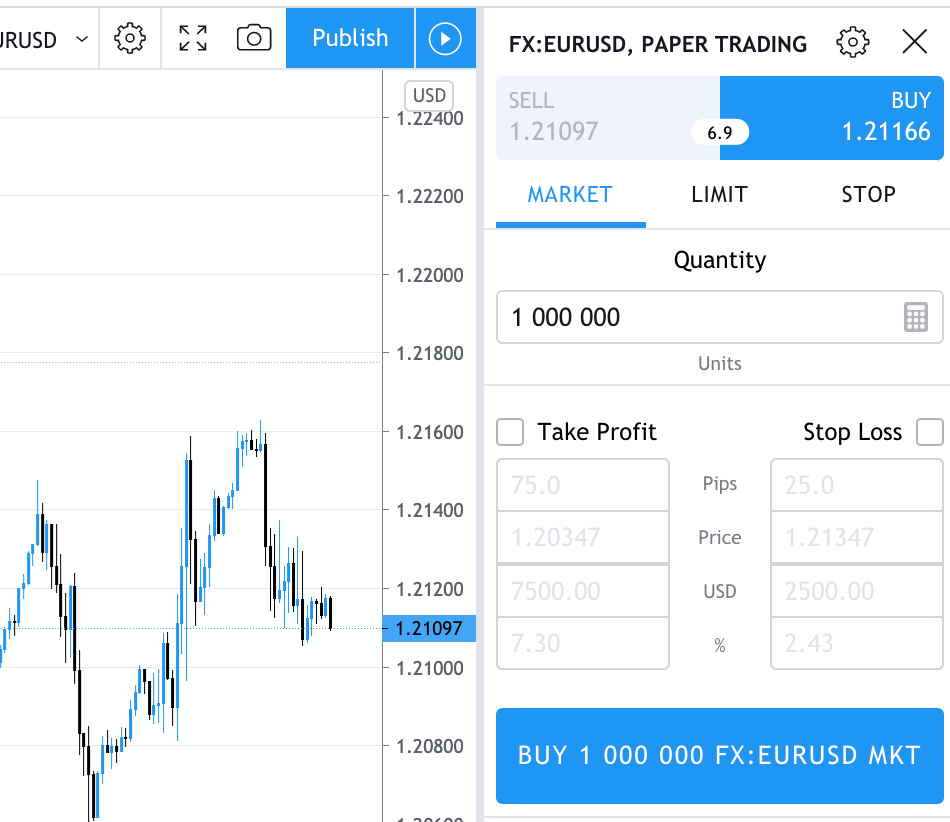

Paper trade first

Paper trading has been added to TradingView which allows you to trade like a demo account but with even less emotion. Demo accounts usually run on MT4/MT5 and these are usually mobile. Being mobile distracts you and can make you trade watch, leading to boredom trading.

Try using the Paper Trading feature on TradingView to see if this improves your trading.

Risk Management In Summary

If you have an effective risk management strategy, you will have greater control over your profits and losses in future trading.

0 Comments