Three drives pattern is a harmonic pattern in Forex with 6 points which are used to define reverse of the market by using Fibonacci ratios.

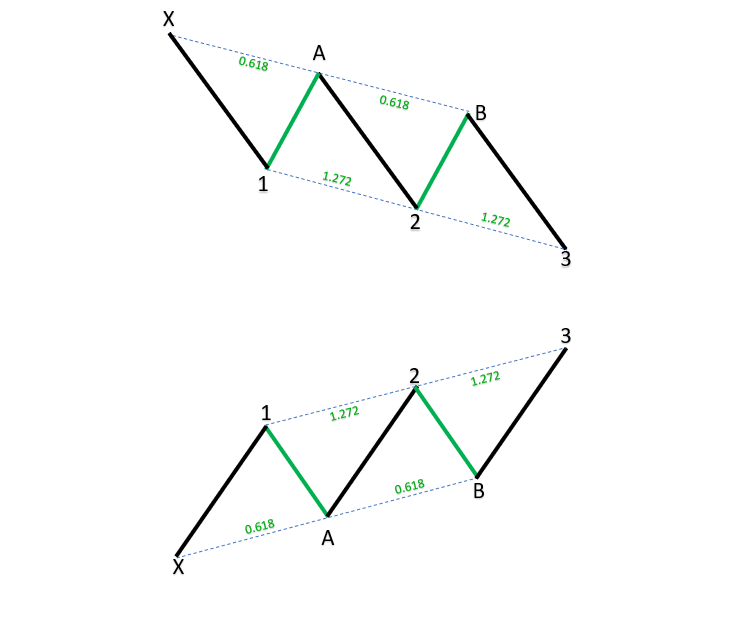

Three drives pattern 6 points are X, 1, A, 2, B, 3. It has three legs which are also called drives:

- X-1 leg

- A-2 leg

- B-3 leg

You also have two retracement legs, 1-A and 2-B which have 0.618 Fibonnaci retracement ratio.

Three drives pattern is similar to 121 pattern which also has symmetrical legs and it has a 0.618 retracement leg and you can find similarities with formations like ABCD pattern and XABCD pattern.

Harmonic Bat Pattern Analysis 27.7.2024

Do not forget to join facebook community where you can see trading ideas, strategies and share...

Harmonic Bat Pattern Analysis 20.7.2024

Do not forget to join facebook community where you can see trading ideas, strategies and share...

Harmonic Bat Pattern Analysis 13.7.2024

Do not forget to join facebook community where you can see trading ideas, strategies and share...

Three Drives Pattern Rules

Here are the rules you need to follow to draw correctly three drives pattern:

- Correction A has to be a 0.618 retracement of drive x-1

- Correction B has to be a 0.618 retracement of drive A-2

- Drive A-2 has to be a 1.272 extension of correction A

- Drive 3 has to be a 1.272 extension of correction B

The three drives are symmetrical and pay attention that they are symmetrical in time and price. If the time and price does not fit then move on to the next opportunity.

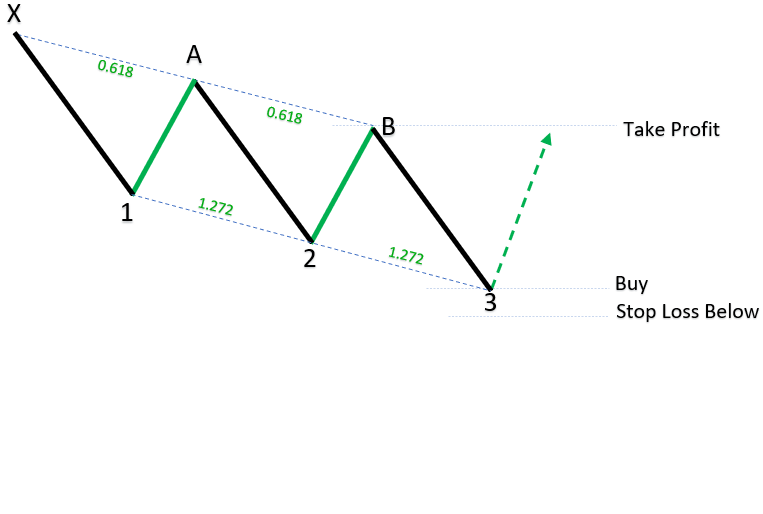

Bullish Three Drives Pattern

Bullish three drives pattern forms in a downtrend where all lows and highs are lower than previous lows or highs.

The retracement of each leg, 1-A or 2-B, is 0.618 of previous leg, X-1 leg or A-2 leg.

When the retracement happens you get one point where the pattern starts to form itself.

Then you get a lower point as a extension of the previous drive which means the market is pushing forward down and you can expect exhaustion again. With the exhaustion you get another retracement of 0.618 to form the B point.

And the last drive is a swing from B point to point 3 as a bearish swing which is again 1.272 extension of previous swing aka drive A-2.

On the last point, point 3 you get an entry point as a potential reversal zone where the price will move higher and it will be a start of trend reversal.

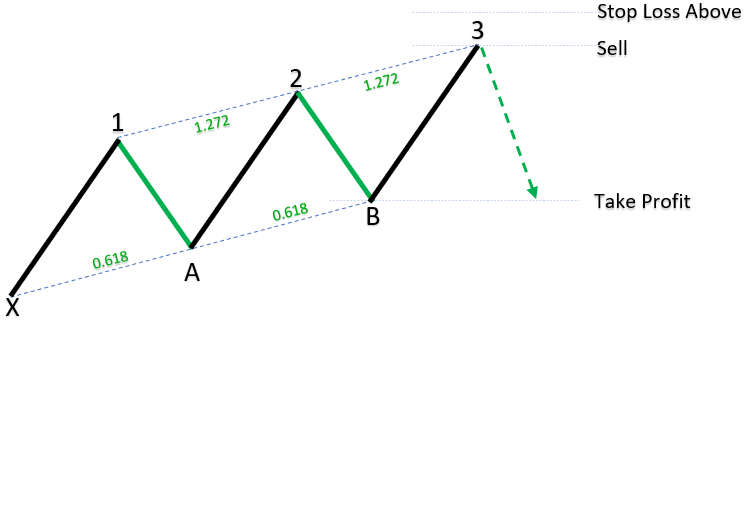

Bearish Three Drives Pattern

Bearish three drives pattern forms in a uptrend where all lows and highs are higher than previous lows or highs.

The retracement of each leg, 1-A or 2-B, is 0.618 of previous leg, X-1 leg or A-2 leg.

When the retracement happens you get one point where the pattern starts to form itself.

Then you get a higher point as an extension of the previous drive which means the market is pushing forward up and you can expect exhaustion again. With the exhaustion you get another retracement of 0.618 to form the B point.

And the last drive is a swing from B point to point 3 as a bullish swing which is again 1.272 extension of previous swing aka drive A-2.

On the last point, point 3 you get an entry point where the price will move lower and it will be a start of trend reversal.

Three Drives Pattern Trading

Because it is a reversal harmonic pattern you can use the point 3 as a reversal point. But if you are a trader that wants to have more signals pointing to a trend reversal you can use additional tools.

Three drives pattern can be used as a starting point in defining the trend reversal or it can be the last signal in trend reversal.

That means you can use support and resistance levels to define the reversal area. Or you can use price action patterns which will help you define the entry for a trend reversal.

Here are the ways how you can enter into the trade:

- Set a pending sell or buy order at the last 127.2 percent level which is extension of B-3 leg.

- The stop-loss can be set few pips below or above the current swing low or high

- Take profit can be set on the B point which will be the first resistance for the price on the trend reversal

Having the trade in profit and reaching the B point it would be a good idea to move stop loss to break even just in case the market decides to return in the previous trend direction.

Conclusion

Three drives pattern is a reversal pattern that shows you when the trend will reverse. It has 6 points or levels which are used to define 5 legs where you have three drives or swing and 2 retracement legs.

If you are a trader already in the trade and you see the pattern forms on the chart it is a good idea to think about exiting the current trade because a potential reverse in the trend could happen.

To be a valid pattern, three drives pattern must have symmetrical retracements and swings.

If you want to have more trading information about harmonic patterns feel free to send a request below on the link where you will get FREE PDF.

Harmonic Patterns Cheat Sheet

All Harmonic Patterns on one place with important tips for trading.

0 Comments