XABCD pattern is harmonic pattern in Forex that has five points, X, A, B, C, D which makes four legs, X-A, A-B, B-C and C-D.

XABCD harmonic pattern is a pattern where other four major patterns are made from it. Those are Gartley, Butterfly, Crab and Bat.

The base is ABCD pattern with four points and only two Fibonnaci ratios used to determine the potential reversal zone. It is similar to 121 pattern, but 121 pattern uses clear Fibonnaci ratios to define D point.

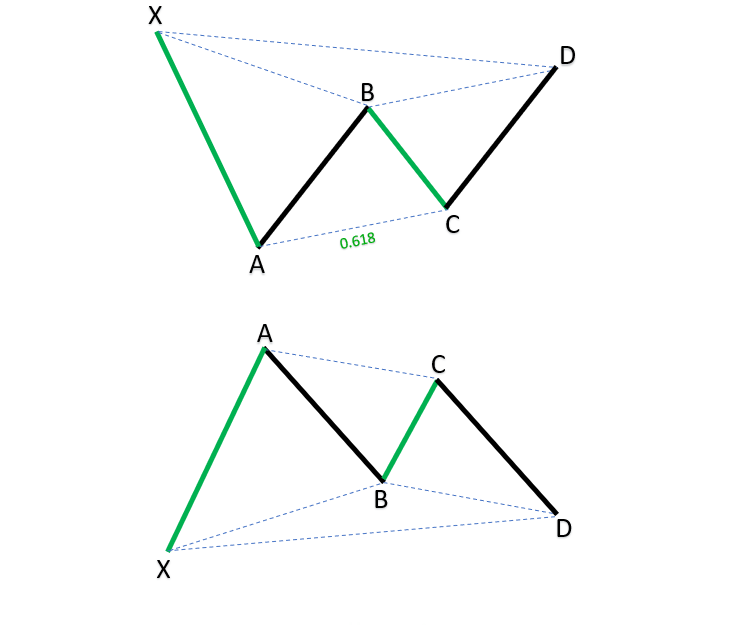

It is similar to three drives pattern which has symmetrical legs and 0.618 retracement leg.

Harmonic Bat Pattern Analysis 27.7.2024

Do not forget to join facebook community where you can see trading ideas, strategies and share...

Harmonic Bat Pattern Analysis 20.7.2024

Do not forget to join facebook community where you can see trading ideas, strategies and share...

Harmonic Bat Pattern Analysis 13.7.2024

Do not forget to join facebook community where you can see trading ideas, strategies and share...

What Does the XABCD Pattern Tell You?

XABCD pattern tells you where the price will reverse or continue the trend which was formed earlier.

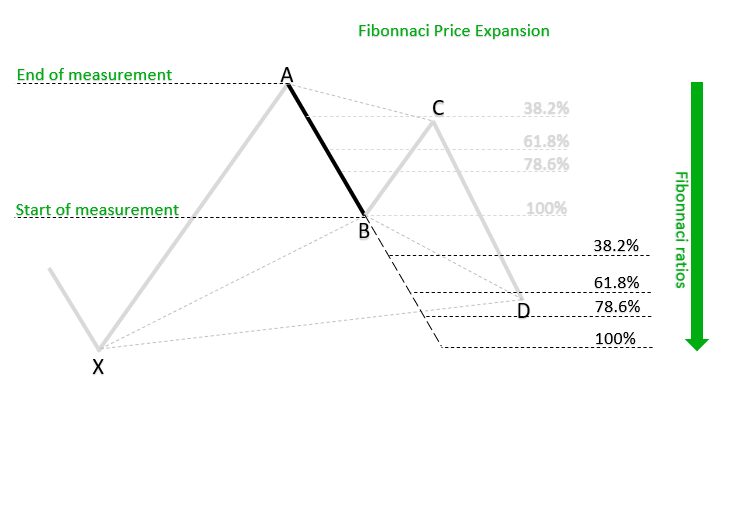

Some patterns are called extension or retracement patterns because of the Fibonnaci ratios which defines them.

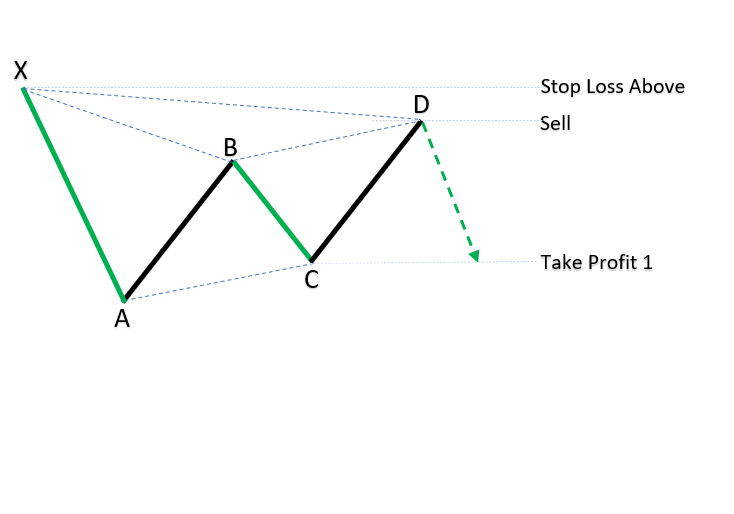

For example, extension patterns are those which have D point beyond X point. Below you can see an image that shows you how that looks like.

Expansion ratios tells you where the reversal price will be so you can prepare to enter into the trade.

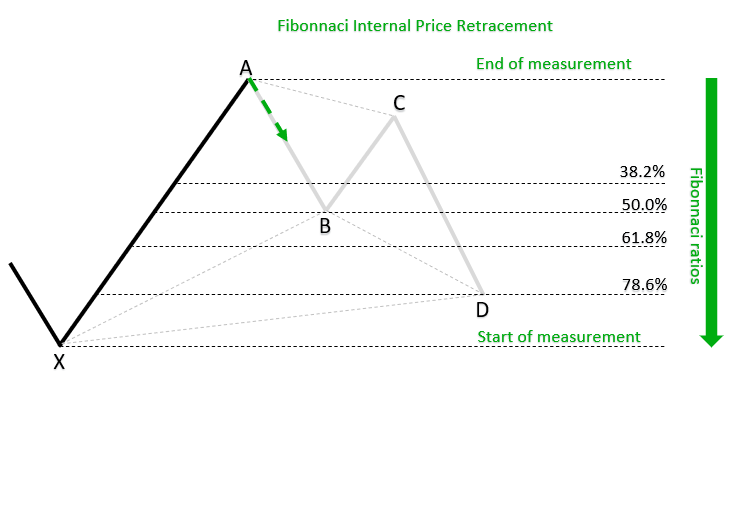

Then you have retracement XABCD pattern which has a D point between X and A point. It means the D point is inside the harmonic pattern.

Take a look at the image below.

Image shows you the XABCD pattern which has a D point inside the pattern and it tells you where the potential reversal zone or PRZ will be.

At that zone you can prepare to enter into the trade.

How to Use XABCD Harmonic Pattern

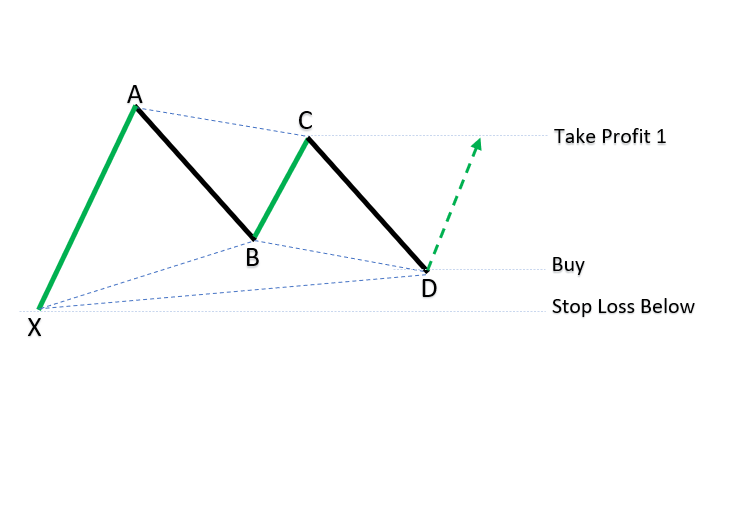

You can use the XABCD pattern as a retracement pattern because it has a D point between X and A point.

D point which has around itself a potential reversal zone is a point that you should watch to enter into the trade.

Like in the case of ABCD harmonic pattern you should wait for the price to come to D point and then prepare stop loss and take profit levels.

Stop Loss level should be above X point because the goal of XABCD pattern is to reverse on D point and move towards B and C point.

The take profit target would be at the C point.

Where Can I Find XABCD Patterns?

It is hard to spot XABCD harmonic patterns like any other harmonic pattern with an eye so the traders use harmonic scanners to detect harmonic patterns.

Harmonic scanner is an application or indicator which you use to receive notification when the pattern appears.

If you can train your eye and you have a skill to detect harmonic patterns then feel free to analyze the market. But, have in mind that emotions will have impact on you and you could see patterns when there is none on the chart.

It will be hard to find the XABCD pattern without making a mistake in detecting it. Finding XABCD patterns will require time to develop the skill needed to detect the pattern.

If you want to find the pattern then focus on time frames higher than one hour H1. Looking for the pattern on the higher time frame, like H4 or D1, will be much less time consuming and you will get more reliable patterns.

Then, look for a swing that will make X-A leg. It is good to look in a trend channel next to support and resistance lines. That way you will increase the accuracy of a pattern when it appears.

Bullish XABCD Harmonic Pattern

In the case of a bullish XABCD pattern you will have X point on the lowest point on the chart. It will be the starting point.

A point will be the highest point of the pattern and it will represent one of profit target levels.

D point will be close to X point, but it cannot go below X point. If the D point goes below then the pattern is not valid.

Bullish XABCD pattern shows you where the price will reverse in the direction of X-A leg.

Entry point is the D point where the PRZ zone is.

Profit target is C target and later on A point is a possible target. But if you reach C point it is the best to move your stop loss to be even.

Stop loss should be placed on the X point or a little below so you avoid any price spikes which could reach your stop loss and then reverse back up.

Bearish XABCD Harmonic Pattern

Bearish XABCD pattern is just the opposite to the bullish pattern. You will have X point on the highest point on the chart. It will be the starting point.

A point will be the lowest point of the pattern and it will represent one of profit target levels.

D point will be close to X point, but it cannot go above X point. If the D point goes above then the pattern is not valid.

Bearish XABCD pattern shows you where the price will reverse in the direction of X-A leg.

Entry point is the D point where the PRZ zone is.

Profit target is C target and later on A point is a possible target. But if you reach C point it is the best to move your stop loss to be even.

Stop loss should be placed on the X point or a little above so you avoid any price spikes which could reach your stop loss and then reverse back down.

Conclusion

XABCD pattern is a five point pattern with 4 legs which is the base for all other harmonic patterns.

XABCD pattern is not a clean pattern that can be traded on its own, but different Fibonnaci ratios define advanced harmonic patterns like Gartley, Butterfly, Crab and Bat.

If you want you can trade the pattern on your own or you can use harmonic scanner to detect harmonic patterns. But, in any case you need to prepare to sharpen your skills to trade harmonic patterns.

Harmonic Patterns Cheat Sheet

All Harmonic Patterns on one place with important tips for trading.

0 Comments