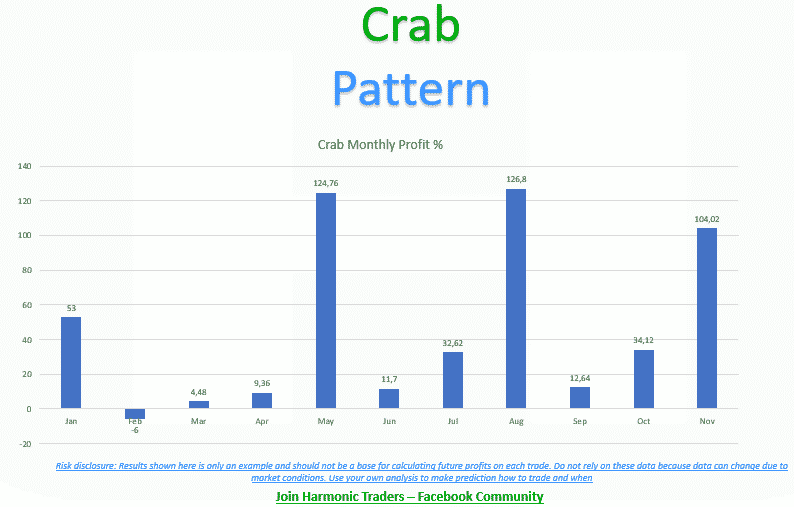

Harmonic Crab Pattern in Forex is one of the most precise harmonic patterns in Forex for trading which gives you great risk to reward returns.

Crab pattern was developed by the Scott Carney in 2000 and you can find more details in his book about harmonic trading.

Harmonic Bat Pattern Analysis 29.3.2025

Do not forget to join facebook community where you can see trading ideas, strategies and share...

Harmonic Bat Pattern Analysis 22.3.2025

Do not forget to join facebook community where you can see trading ideas, strategies and share...

Harmonic Bat Pattern Analysis 15.3.2025

Do not forget to join facebook community where you can see trading ideas, strategies and share...

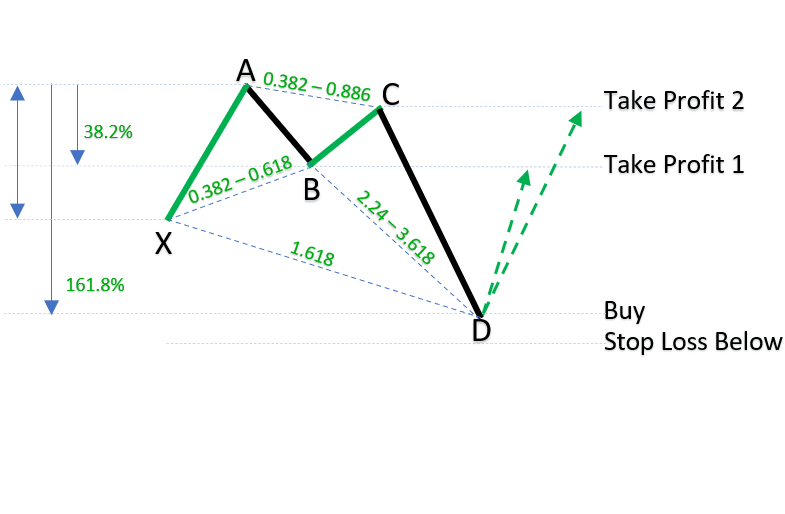

Harmonic Crab Pattern Rules

Crab pattern is one of the extension harmonic patterns like Butterfly pattern. It is not a retracement harmonic pattern like Gartley pattern and Bat pattern.

What that means is that the D point is not between X and A point, but the D point goes beyond X point. Five point pattern is based on the simple XABCD pattern that has ABCD pattern in its foundation..

Rules to verify Crab pattern as a valid pattern are here:

- D point defined by a 1.618 Fibonacci extension of the X-A leg

- C-D leg Fibonacci extension between 2.24-3.618 of A-B leg

- B-C leg is minimum of 38.2% and maximum 88.6% Fibonacci retracement of A-B leg

- A-B leg is a retrace between 0.382 – 0.618 Fibonnaci retracement of X-A leg

- B point retracement to be 0.618 or less

Crab patterns to be validated must comply with above rules or else do not trade it. If you cannot draw legs by yourself use harmonic scanner to detect Crab patterns.

Image above shows you two Crab patterns, bearish(above) and bullish(below). What you can see is that the D point is not between X and A point which makes it different compared to Bat pattern and Gartley pattern.

Entry levels are on the D point and stop loss level is just above or below D point. Crab pattern with extension point D is a volatile pattern which means the price will be volatile around D point and you need to be quick with trading decisions.

Let me explain the bearish and bullish Crab pattern so you know how to trade them.

Bullish Crab Pattern

Bullish Crab pattern will have D point below X point. D point is PRZ meaning a potential reversal zone where the price reverses. It is also a place where you will find entry price level.

At that point you will open a trade and set stop loss just below.

At the D point you can expect the price to be volatile. Volatility in Forex will cause the price to jump quickly and it could happen that you miss the chance to enter into the trade or you could have your stop loss hit if you put it too close to D point.

To make the best out of it you could set Buy limit order which will open automatically if the price reaches your entry target price. That way a trading platform will execute trade on its own without you.

Stop Loss put away from the D point, but base the stop loss on the support and resistance level. Support and resistance level will help you see what is a safe place where the price will not come if the pattern is valid.

Bearish Crab Pattern

Bearish Crab pattern will have D point above X point. D point is a potential reversal zone also known as PRZ where the price reverses. It is also a place where you will find entry price level.

At that point you will open a trade and set stop loss just above D point.

Like in the bullish scenario you can expect high volatility because the price has come to a point where there will be a lot of traders entering into and exiting from the market.

To be prepared the best is to set Sell limit order which will open automatically if the price reaches your entry target price. That way a trading platform will execute trade on its own without you.

Sell limit order will sell order when the price goes up and then reach the D point.

Stop Loss put away from the D point, but base the stop loss on the support and resistance level. Support and resistance level will help you see what is a safe place where the price will not come if the pattern is valid.

How Do You Trade Crab Patterns?

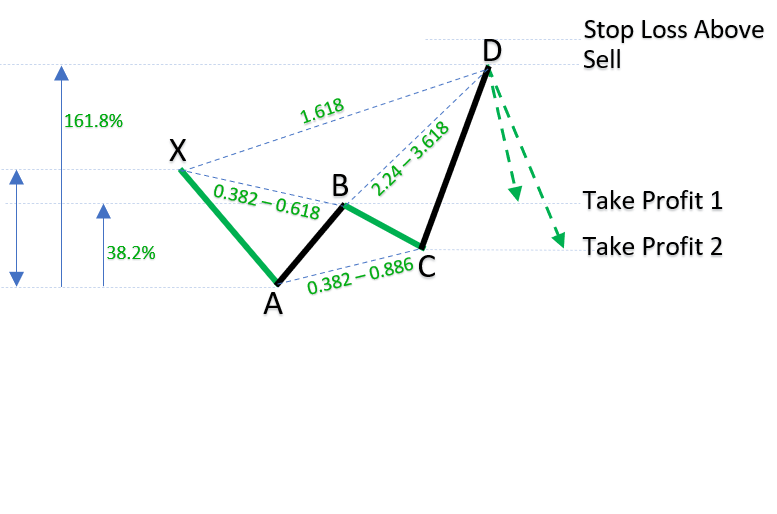

One example of a bullish Crab pattern is below in the image. You can see all points drawn on the chart.

D point is below X point which makes this Crab pattern valid and the extensions with retracement of each leg are valid.

On the D point you can see a blue horizontal line which represents support in this case which makes the D point more valid point for entering into the trade.

Another confirmation is the bullish Pin bar you can see at the bottom. It is the lowest candle on the chart which is suggesting the price will move up.

After a few candles later on you see the price is moving up which confirms crab pattern as a valid and if you trade it you will be profitable.

Stop loss is below the bullish Pin bar which makes this trade highly profitable because of small stop loss.

This was created in one hour H1 time frame. Chart used was on the harmonic scanner app which you can have by checking the link below. It was drawn automatically for me and I have received notification on my mobile phone.

Trade crab pattern

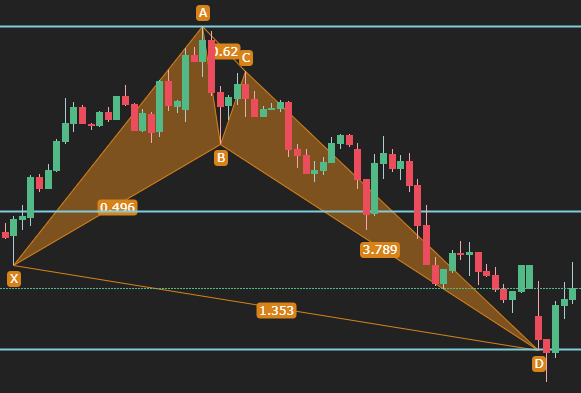

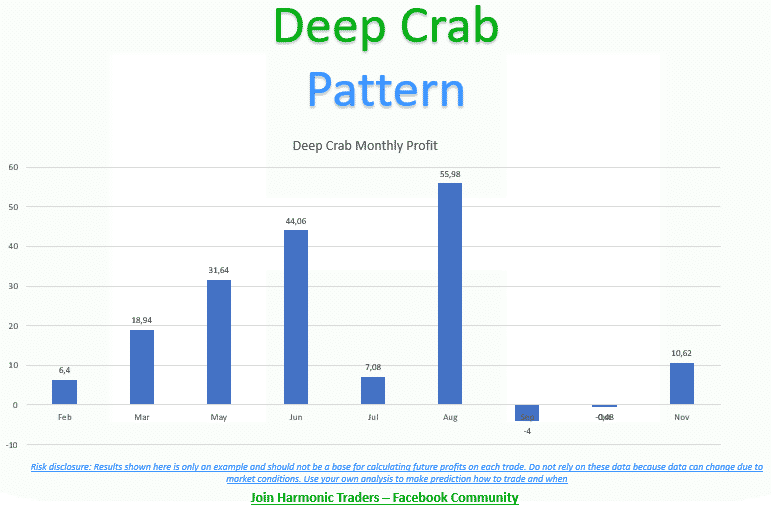

Deep Crab Pattern

Deep Crab pattern is similar to Crab pattern, but it has A-B and C-D leg differently drawn and B point is 88.6% retracement of X-A leg.

Deep Crab pattern has 5 points like the Crab pattern and it has a D point which is also outside X-A leg.

Like the Butterfly pattern Crab pattern tells the traders when the price direction is coming to an end. It tells you when the price will reverse and change direction.

D point signal when the price reaches a peak and when you can expect to enter into the trade with trend direction change.

Crab and deep Crab means overbought or oversold area on the chart where the price will likely reverse. When that happens the change is quick and swift.

Deep Crab Harmonic Pattern Rules

Here are key differences deep Crab pattern compared to Crab pattern:

- The B-C leg is not as extreme as the crab version

- B point has to be at least an 88.6% retracement

- The B-C leg is a minimum of 224%, but can extend to 361.8%

- B-C leg exists between X-A leg

- C point is higher low than A point in case of bearish Crab pattern

- C point is lower high than A point in case of bullish Crab pattern

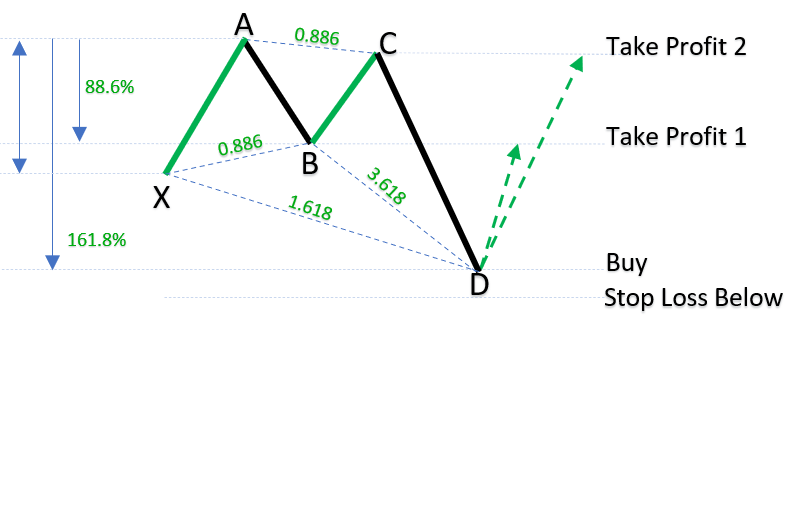

Bullish Deep Crab Pattern

The Bullish Deep Crab pattern has no much difference to the common bullish Crab pattern. The trading rules are the same, but the B point is different and it has higher retracement of XA leg.

Image below shows you a bullish deep Crab pattern where you can see B point as 88.6% retracement of X-A leg.

C point is almost on the same height as A point, but the C has lower high than A point.

D point is on the same point like in the clean bullish Crab pattern.

Trading rules are the same. D point is the reversal point where the price tends to change direction very quickly.

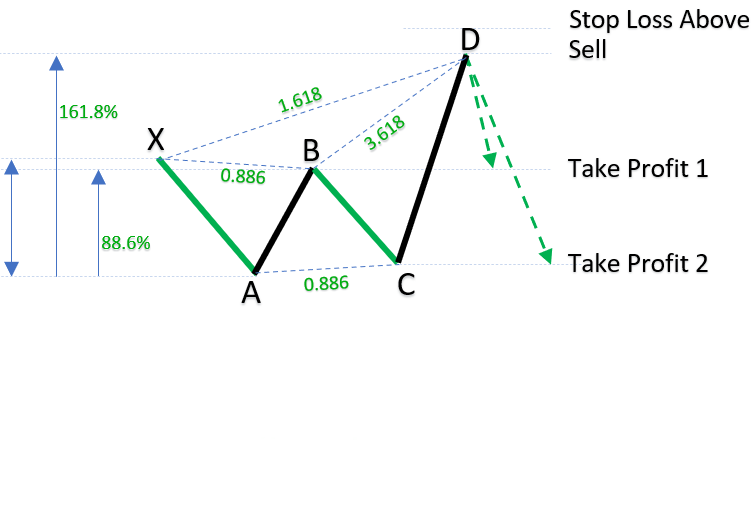

Bearish Deep Crab Pattern

Bearish Deep Crab pattern like bullish has the same changes compared to the common Crab pattern.

B point is 88.6% retracement of X-A leg.

C point is higher low than A point and the D point is on the same place like in the bearish Crab pattern.

Trading rules are the same like in the bearish Crab pattern. D point is a reversal point where you can enter into the trade and it is a point where the price will quickly change direction.

Bearish deep Crab patter target is shown on the image and they can be used if you want, but you can modify them if they do not fit your trading strategy.

Sometimes the Crab pattern target is not conservative so you can put more risk on each trade, but do not forget to set Stop loss.

Conclusion

Crab pattern as was said in the beginning is quite a precise harmonic pattern with good risk to reward ratio.

Around D point you can expect high volatility where you could use automatic entering into the trade with buy limit in case of bullish Crab pattern and with Sell limit in case of bearish Crab pattern.

Crab pattern as any other harmonic pattern requires certain skills to be drawn or spotted on the chart, but with the help of harmonic scanner you can help yourself to save time.

If you want to see which trading tips are useful that will help you in trading harmonic patterns feel free to download them on the link below.

Harmonic Patterns Cheat Sheet

All Harmonic Patterns on one place with important tips for trading.

0 Comments