The 5.0 harmonic pattern is a XABCD pattern with an additional 0 point which suggests trend reversal by having B point as a last point in the trend direction.

5.0 pattern is modified Shark pattern where you need first to find Shark pattern and then check the 5.0 pattern rules to verify where the potential reversal zone is.

Harmonic Bat Pattern Analysis 27.7.2024

Do not forget to join facebook community where you can see trading ideas, strategies and share...

Harmonic Bat Pattern Analysis 20.7.2024

Do not forget to join facebook community where you can see trading ideas, strategies and share...

Harmonic Bat Pattern Analysis 13.7.2024

Do not forget to join facebook community where you can see trading ideas, strategies and share...

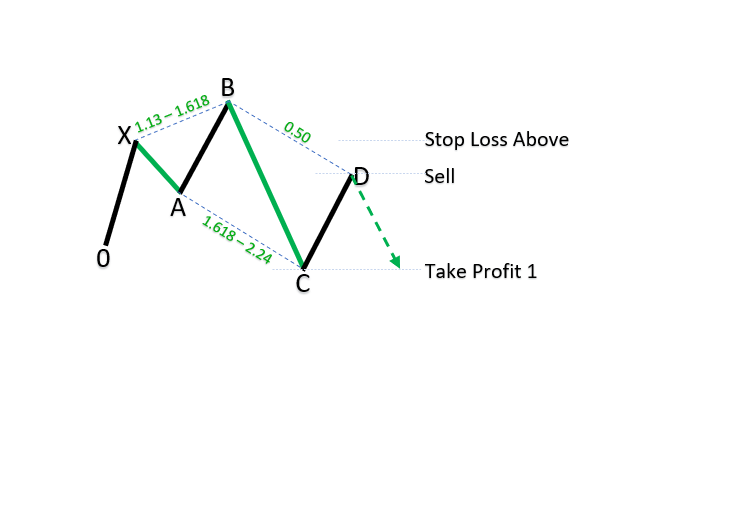

5-0 Pattern Rules

The 5-0 harmonic pattern in Forex appears in the trend, uptrend or downtrend, which is coming to an end.

Here are the rules you need to follow when drawing the pattern:

- A-B leg has to be 1.13 to 1.618 retracement of X-A leg

- B-C leg has to be 1.618 to 2.24 retracement of an A-B leg

- C-D leg should to be 0.5 retracements of B-C leg

- C point should be between 0.886 – 1.13 of 0-X leg

When making a harmonic pattern you need to pay attention to the B-C leg because it is one of the most important parts of the 5-0 pattern. It is the longest leg and it must comply with Fibonnaci ratios of A-B leg.

Then the D point will be in the potential reversal zone which is 50% retracement of B-C leg.

As you can see on the chart A-B leg is the same length as C-D so this is also a confirmation of 5-0 success formation.

If you want to read more about the 5-0 pattern which was invented by Scott Carney in his harmonic trading book.

Bearish 5-0 Harmonic Pattern

Bearish 5-0 pattern should be formed, not necessarily mandatory, in the uptrend so it can have a much higher success rate.

Bearish 5-0 is drawn as Shark pattern, but with additional C-D leg. That means you can first have the Shark pattern on the chart and then wait until C-D retracement happens.

B-C leg have two Fibonnaci rules so you can watch two bearish scenarios. The final difference will be in your profit target because the C point has two different lengths.

You need to watch out that the A-B leg is reciprocal to C-D leg, AB=CD, to pattern be valid.

Bullish 5-0 Harmonic Pattern

Bullish 5-0 pattern should be formed, not necessarily mandatory, in the downtrend so it can have a much higher success rate.

Bullish 5-0 is drawn as Shark pattern, but with additional C-D leg. That means you can first have the Shark pattern on the chart and then wait until C-D retracement happens.

B-C leg have two Fibonnaci rules so you can watch two bullish scenarios. The final difference will be in your profit target because the C point has two different lengths.

You need to watch out that the A-B leg is reciprocal to C-D leg, AB=CD, to pattern be valid.

Trading 5-0 Pattern

Look for uptrend or downtrend because that is the first step in trading 5-0 pattern. Then you need to wait until the 5-0 pattern appears, but it must be reversal pattern.

That means in the uptrend you need to look for a bearish 5-0 pattern.

In the downtrend you need to look for a bullish 5-0 pattern to have a high chance of success.

When you find the 5-0 pattern which is drawn by the 5-0 pattern rules you can look for D point as an entry point.

If you have bullish 5-0 pattern you can set stop loss below D point because the price should move down.

In the case of bearish 5-0 pattern you can set stop loss above D point.

Profit target is not simply defined by you can look for the first target at the C point. Because the pattern suggests the previous trend ends, this means you are targeting a new trend.

So, it is not easy to say where the new trend will have first resistance.

Because of that you can use C point as a first profit target and then at least break even in case the market changes the direction and returns back to D point.

Conclusion

5-0 harmonic pattern is one of its kind. It is a combination of Shark pattern and ABCD pattern and 0 point which defines the starting point.

It is a reversal pattern which tells you the trend has come to an end.

The 5-0 pattern has a bearish and bullish type so you can trade it in bearish and bullish market.

Important to remember is to follow 5-0 pattern rules to have a valid pattern on the chart.

To help you find the Shark pattern which is the beginning of the 5-0 pattern use harmonic scanner which will detect the pattern for you.

Harmonic Patterns Cheat Sheet

All Harmonic Patterns on one place with important tips for trading.

0 Comments