The Gartley Pattern is one of six harmonic chart patterns in Forex which uses Fibonnaci ratio and numbers to define key points that define patterns. The Gartley pattern is used by traders to get trading entry price levels with possible stop loss and take profit levels.

Harmonic Bat Pattern Analysis 20.4.2024

Do not forget to join facebook community where you can see trading ideas, strategies and share...

Harmonic Bat Pattern Analysis 13.4.2024

Do not forget to join facebook community where you can see trading ideas, strategies and share...

Harmonic Bat Pattern Analysis 30.3.2024

Do not forget to join facebook community where you can see trading ideas, strategies and share...

Gartley Pattern in Forex

Gartley Pattern was invented by H.M. Gartley while being active on the stock market.

Now, Gartley pattern is also used on the Forex market for trading currency pairs, on the cryptocurrency market for crypto pairs and on indices.

Patterns consist of five points which define price levels. Those price levels are defined by the length of each leg which are defined by the Fibonacci ratios.

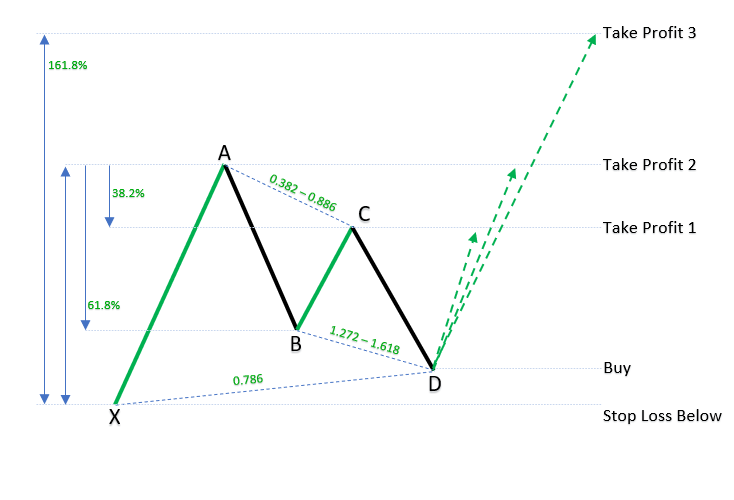

Image below shows you the Gartley pattern with each leg and the length between certain points.

The Gartley pattern has the following characteristics which are considered as the perfect levels:

- Leg AB should be the 0.618 retracement of move XA.

- Leg BC should be either 0.382 or 0.886 retracement of move AB.

- If the retracement of a BC leg is 0.382 of a AB leg, then CD leg should be 1.272 of a BC leg. If BC leg is 0.886 of a AB leg, then CD leg should extend 1.618 of BC leg.

- CD leg should be 0.786 retracement of XA leg

Gartley pattern is a retracement pattern as Bat Pattern which means the pattern consist of X point which acts as a support/resistance level because all is connected with it.

Looking from the X point the price will make a retracement from one price for certain amount. That means the price will make a retrace from point A to X for certain amount.

The last point D must be between point X and A or else the pattern is not valid. You will finally have XABCD pattern which is the basic pattern for all harmonic patterns in Forex.

Important Factors to Watch Out

The pattern should have AB CD pattern because it is main part of the Gartley.

Then, the AB leg should have same number of bars as CD leg which would make the pattern more reliable.

Point B which is a retracement point from point A towards point X should be around 0.618 of XA leg.

The point B can have three possible retracement levels. Fibonnaci ratio 0.382 of XA leg for a small retracement, 0.618 as the best retracement and 0.786 for a large retracement.

Gartley Meaning

Gartley means a name of Harold McKinley Gartley who invented the Gartley pattern. Gartley has also 222 meaning which is a page number in his harmonic trading book Profits in the Stock Market.

You can find the book on the link below. Inside the book you can see what Gartely thought about the harmonic chart and which basic foundation has been laid down.

Gartley pattern also means a pattern which includes ABCD pattern. They appear when correction in a formed trend is going to happen.

This is useful because if you think that the trend will continue and you want to jump in, but with a good entry point then you can use the Gartley pattern for that.

When the pattern appears you can jump in and ride on the trend with good entry points.

How Do I Know What Gartley Pattern I Have?

You have two types of Gartley patterns. One is for the bullish scenario and second one is for the bearish scenario.

Bullish Gartley pattern appear when you have an uptrend and the market stalls for some reason. It makes retracement and prepares for continuation of the trend.

Bearish Gartley pattern appears when you have downtrend and the market stalls for a moment. Market makes a retracement and prepares for continuation of the trend.

Below you can see an image of the Gartley pattern with five points X, A, B, C and D. Those points are showing you price levels where the price could make a direction change.

The price values are determined by the Fibonnaci ratios, but the price does not need to hit 100% correct price level. It can be near that level, but closer it is to that level it is better. The pattern will be more reliable.

Now I will show you the bearish and bullish Gartley pattern you can expect on the Forex market. Bearish pattern is for downtrend and bullish pattern is for uptrend scenario.

What is Bearish Gartley Pattern?

The Bearish Gartley pattern has XA leg bearish. That means the price is moving down from X point to A point.

It is showing that the price will move more down when the price reaches the D point on the chart. This is a good point to get into the trade because the market is moving already down and you have an opportunity to get on that trend on the pullback.

You enter on the D point and look for an exit at the target price. First target is on the point C, then on the point A and finally on the 161.8% point.

Final point is sometimes called the E point, but I have not put that on the image. You can if you want.

What is a Bullish Gartley Pattern?

The Bullish Gartley pattern has XA leg bullish. That means the price is moving up from X point to A point.

It is showing that the price will move more up when the price reaches the D point on the chart. This is a good point to get into the trade because the market is moving already up and you have an opportunity to get on that trend on the pullback.

You enter on the D point and look for an exit at the target price. First target is on the point C, then on the point A and finally on the 161.8% point.

Final point is sometimes called the E point, but I have not put that on the image. You can if you want.

Gartley Pattern Trading

Trading gartley pattern includes defining market overview which then can be used with other indicators or technical analysis to define where the price will go in the future.

If you combine a Gartley pattern with a candlestick pattern like Pin bar or engulfing bar and add support and resistance levels you can get a really good trading setup.

That means, you use Gartley pattern entry levels, exit levels for Stop Loss and Take Profit like this.

You use the daily time frame and Gartley pattern. When you have drawn the Gartley pattern on the chart you can see future trend movement.

Then use a four hour H4 or one hour H1 time frame to get entry levels. Always use trade ideas which are moving in the daily trend.

For example if you have a bullish Gartley pattern and four hour H4 signal pointing the price will move higher, that way you have two confirmations the price will move up, bullish scenario.

You have a daily time frame which has a Gartley pattern and four hour H4 signal both pointing in the same direction which increases the chance of success.

If you use this strategy all the time you can have good success rate and then decide which risk to reward ratio you should use and how much should you invest per trade.

Trading Tips

If you are interested you can get trading tips which usually give good results when trading Gartley Pattern.

- In which time or market overview is good to look for Gartley pattern – is it in uptrend, downtrend, channel or on the top/bottom

- When is not a good time to trade Gartley pattern

If you want to get these trading tips let me know.

Harmonic Patterns Cheat Sheet

All Harmonic Patterns on one place with important tips for trading.

Real Trading Example

Below in the image you have a real example of an AUDCAD pair where the bullish Gartley pattern is shown.

As you can see the retracement levels are in the Fibonnaci ratios that define the bullish Gartley pattern.

The retracement:

- between point X and A for B point is 0.616 which is close to 0.618

- between point X and A for C point is 0.638 which is between 0.382 – 0.886

Point D is between points X and A which gives us a clean Gartley pattern. The D point is calculated potential reversal zone which have several Fibonnaci ratios pointing to that area.

Now I can enter into the trade here at this moment and set stop loss below X point.

First profit target can be at point C and if I want to be more conservative I can put profit target between point B and C.

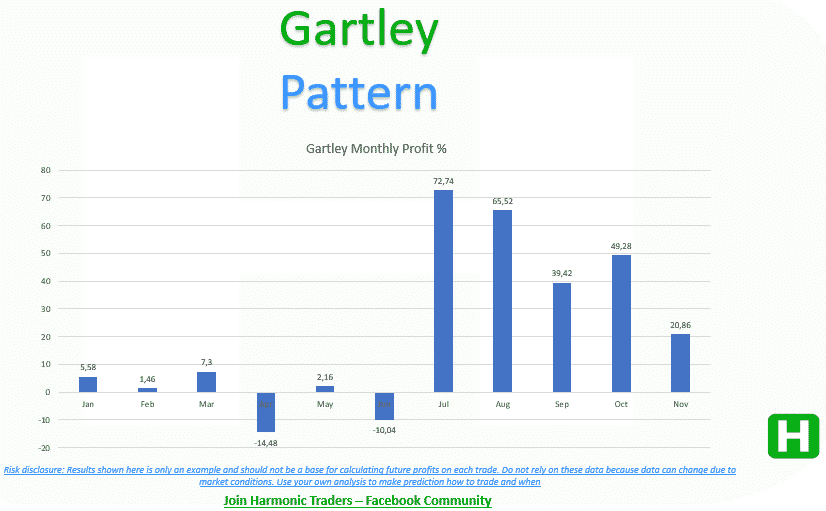

Gartley Pattern Success Rate

Success rate of Gartley Pattern is around 80% like majority harmonic patterns. Some of them can have more than 90% success rate which must be tested before using it on the real trading chart.

You need to select the Gartley pattern and test it on the chart does the pattern gives you good trading results on different time frames.

You can use a four hour time frame and backtest it a year backwards. With those results you will see which shape and when pattern gives you the best results. That way you filter out those that are not successful.

Then you use that strategy for the next month and test to get the same results like you have on the backtesting.

If you do, then you have a success rate you can expect in your future trading.

Using support and resistance levels can increase the success rate of Gartley pattern so feel free to draw support and resistance levels in your trading.

Gartley Pattern Scanner

Gartley pattern example above is drawn automatically by the harmonic scanner which makes pattern detection much easier. If you do not know how to detect a Gartley pattern by yourself or you have trouble drawing correct lines then I suggest you a harmonic pattern scanner which can help you.

Harmonic pattern scanner is a scanner that detects harmonic patterns with the software written by programmers and helps you detect all other harmonic patterns.

You can find a free harmonic scanner, but mostly it is best to use paid software because they are more reliable. Even if you need to pay for a scanner the price you have on the market is not too expensive for anyone.

Some scanners start from $14.99 per month which is quite affordable.

How Do You Use a Gartley Indicator?

Gartley indicator or scanner you use by reading information you see on the chart. You see points which define price levels.

You need to check where the D point is because it is a price where you should enter. Then watch where the exit is if the price goes against you. That is Stop Loss you should enter into the trade.

Then You have profit targets you need to see where you will exit from a trade with profit. Those levels are visible on the chart.

If you use a harmonic scanner then you will have those prices on the chart. If you use indicators then you probably need to read it yourself from the chart.

Conclusion

The Gartley pattern is one of the oldest harmonic patterns on the market. He is also called the 222 pattern or Gartley 222 pattern.

It has W and M shape depending on the market overview, bullish or bearish. That is defined by the XA leg:

- XA leg bullish -> Gartley pattern is bullish

- XA leg bearish -> Gartley pattern is bearish

Start trading with the best harmonic scanner on the market.

0 Comments