121 harmonic pattern is an advanced harmonic pattern in Forex which uses Fibonnaci ratios, market overview and trend to identify reversal or continuation of a trend.

With its precision 121 harmonic pattern gives you a good indication where the trend will move and gives you a good risk to reward ratio.

121 pattern has five points, XABCD, formation like ABCD pattern and XABCD pattern. It uses two Fibonnaci ratios to define B point and D point. It is similar to three drives pattern which has symmetrical legs and 0.618 retracement leg.

121 Harmonic Pattern Rules

To be a valid pattern, 121 pattern has two Fibonnaci ratios which are used to define B point and the D point.

The rules that must be respected are:

- X-A leg is the first swing

- A-B leg is 61.8%-78.6% retrace of X-A leg

- B-C leg is a new swing

- C-D leg is 50%-61.8% retrace of X-C leg

- A-B leg should be the same length as C-D leg

What is good to know is that the D point can also have another zone defined by the Fibonnaci ratio of 50%-78.6% and 61.8%-78.6%.

These new zones were found by trading 121 pattern.

Harmonic Bat Pattern Analysis 17.2.2024

Do not forget to join facebook community where you can see trading ideas, strategies and share...

Harmonic Bat Pattern Analysis 10.2.2024

Do not forget to join facebook community where you can see trading ideas, strategies and share...

Harmonic Bat Pattern Analysis 3.2.2024

Do not forget to join facebook community where you can see trading ideas, strategies and share...

121 Harmonic Pattern Types

121 harmonic pattern appears in bullish and bearish version, but also as a reversal and continuation pattern.

Bullish and bearish version tells you where the price will move when it reaches the final D point.

Reverse or continuation 121 pattern tells you will the trend continue to move in the direction it was moving prior forming 121 pattern or the trend will reverse which suggest trend reversal.

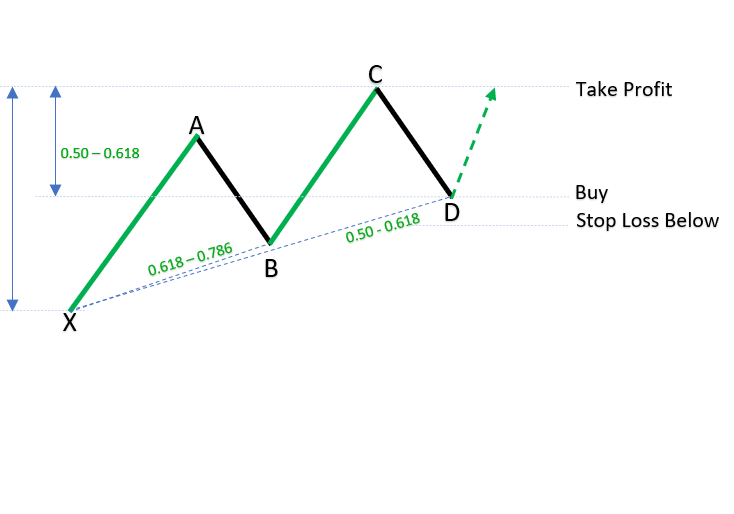

Bullish 121 Harmonic Pattern

Bullish version of the 121 harmonic pattern shows you where the market will make a reverse and then continue to move in the prior direction.

In the image you can see that we have X-A swing which then has a retrace to B point.

A-B leg is a retrace of X-A leg by 61.8% – 78.6% which you can get on the chart by using Fibonnaci tool on any trading platform.

Then we have B-C leg which is another swing and it is not necessary to be the same length as X-A leg.

Then the retrace comes into play and we have C-D leg which is a retrace of X-C leg by 50% – 61.8%.

D point will be our entry point where you can target new highs and stop loss just below D point.

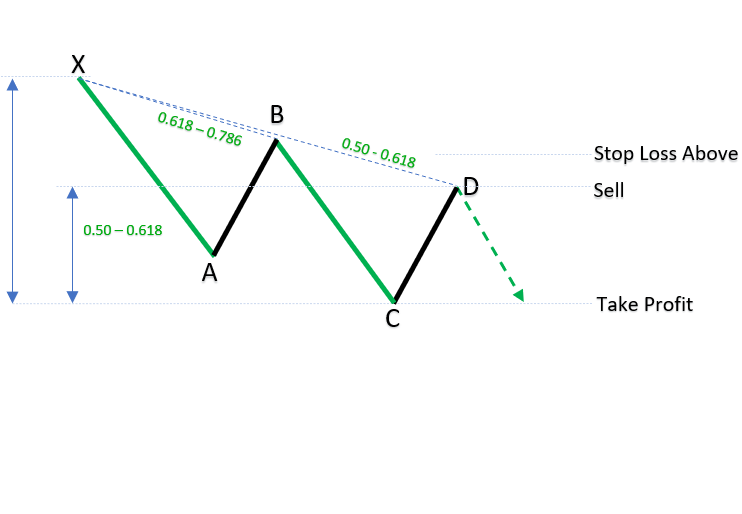

Bearish 121 Harmonic Pattern

Bullish 121 harmonic pattern shows you where the market will make a reverse and then continue to move in the prior bearish direction.

In the image you can see that we have bearish X-A swing which then has a bullish retrace to B point.

A-B leg is a retrace of X-A leg by 61.8% – 78.6% which you can get on the chart by using the Fibonnaci tool that is available on any trading platform.

Then we have B-C leg which is another bearish swing and it is not necessary to be the same length as X-A leg.

Then the retrace comes into play and we have C-D leg which is a retrace of X-C leg by 50% – 61.8%.

D point will be our entry point where you can target new lows and stop loss just above D point.

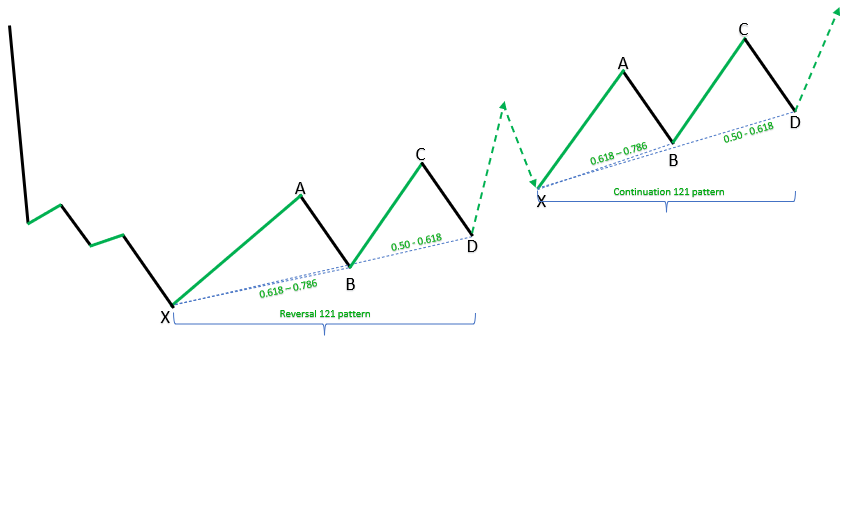

Reversal 121 Pattern

A reversal 121 pattern appears at critical trend reversal points which acts as a market correction.

Reversal type of 121 pattern because of accuracy of 121 pattern and impulse wave that follows the pattern gives really good risk to reward ratio.

In the image below you can see how the trend has ended and the 121 pattern was indicating the trend will reverse where the D point was a really good entry point.

Continuation 121 Pattern

A 121 continuation 121 pattern appears inside the higher impulse wave which is prior impulse before X-A swing impulse.

Some traders use it in a clever way to define the trend because of strong impulse at the beginning.

In the image below you can see how strong market impulse has formed and then we have X-A swing as a start of 121 pattern.

Trading 121 Harmonic Pattern

Up to now you have seen what type of 121 pattern you can have on the chart.

What really matters in the end is that we have probably the most powerful and profitable price pattern forming on the charts.

When you see the first 3 legs completed, X-A, A-B and B-C, and the swing C-D crossing over the 50% of A-B leg then you should prepare yourself.

What you need to do is to prepare Fibonnaci ratios and wait until the price reaches 50% of X-C leg.

That will be the first moment where you should wait the price to make some kind of confirmation it will reverse back.

But, have in mind that the market can go above 50% retracement of X-C leg and that is up to 61.8% – 78.6% zone which is potential reversal zone.

Zone 61.8% – 78.6% is also PRZ internal price retracement because it is inside X-C leg.

Set Stop Loss and Take Profit

When you enter on the D point you can set Stop Loss level just above it. If you have entered on the 50% or 61.8% retracement of X-C leg then set stop loss on 78.6%.

Profit target is your first Fibonnaci ratio below 50% and that is 23.6% retracement of X-C leg and then C point and then below C point in case of bearish, and above C point in case of bullish 121 pattern.

Conclusion

121 harmonic pattern is one highly powerful and reliable pattern when it is formed on the chart.

With simple rules to follow, A-B = C-D leg, and Fibonnaci ratios for D point is really simple for any trader to follow.

With bearish and bullish versions it is easy to trade in both market conditions.

If you want to learn more about 121 patterns I suggest you take a look into the FREE PDF I have prepared for you on the link below.

Harmonic Patterns Cheat Sheet

All Harmonic Patterns on one place with important tips for trading.

0 Comments